The FPSO Kwame Nkrumah (source: Modec)

*Please read the disclaimers at the base of this report. The author has a short position in the companies mentioned below. Does not constitute a recommendation to buy or sell the securities mentioned herein. Do your own due diligence. For Permitted Recipients only (UK - see disclaimers).

Late last year Tullow was dealt a reprieve when the ICC declared against one of Ghana’s three cases against the company (two remain). In the meantime, we have seen the exit of CEO Rahul Dhir, and a rapid fire sale of assets, with both Kenya and Gabon having terms of sale agreed (binding “subject to conditions precedent”) in the case of Gabon). The proceeds from both Kenya and Gabon combined total some $420m (before costs and net offs), although only $300m from Gabon and $80m from Kenya would be due in 2025. Obviously these sales once (and if, in the cases of Kenya) effected would materially reduce Tullow’s debt burden.

That burden, however, has been increasing of late, with the net debt figure at the end of March 2025 of $1.6bn, markedly higher than the $1.45 at year end. While this is blamed on the timing of cargos, there is no obvious change of rhythm in shipments noticeable in the Petroleum Commission of Ghana data. So the $380m minus some deductions of say $20m would only reduce the net debt to $1.24bn, with really only the Jubilee field with the potential to generate meaningful cashflow post costs, given dwindling production at TEN (c16kbd) and the heavy cost burden of the TEN FPSO lease payment. Indeed the AGM statement makes clear that at $65 oil, the company generates negative free cashflow of $30m ex the payments from Gabon and Kenya and the payment of Ghana’s overdue gas bill ($50m) from 2024, a payment that is itself thrown into doubt by the recent license extension agreement. (The extension of the license period appears to be in exchange for an unspecified reduction of the gas price Tullow receives and other undetermined “investments” from Tullow and Kosmos into GNPC).

Below we can see Tullow’s financial commitments from the last annual report:

As we can see above, the backdrop to this sudden flurry of asset disposals is the debt burden and the maturity profile. Since the year end, the company repaid its March 2025 bond in full out of the proceeds of its Glencore loan which has now been fully drawn down, while also drawing down a much shrunken RCF facility of $150m (down from $250m at year end, and expiring in October 2025). Things are tight.

Cashflow

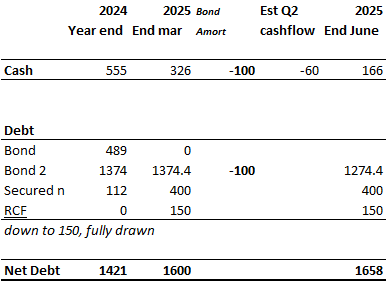

Below is a schematic of the position at year end, at the 31st March, and (my estimates) at the end of June. With the end May payment of $100m of amortisation of the 2026 bond, along with semi annual interest, things are pretty tight, with all facilities drawn and cash likely below $200m in June assuming modest negative free cashflow after payments of interest and debt amortisation of $100m.

The cashflow estimate above for Q2 of minus $60m or minus $160m including bond amortisation) is of course a best guess, but looks plausible given the likely timing of liftings and recent oil price behaviour - see below:

With the possibility of a cash balance below $200m, it is clear that the company is in the danger zone unless they can get the Gabon sale receipts in the weeks ahead. Yet this precarious situation doesn’t even take account of the parlous state of the non-finance elements of the balance sheet.

Working Capital

The non-cash, non debt current assets and liabilities appear to further strain liquidity, with a net negative current asset position. Ex cash and borrowings, Tullow’s non cash net current assets are -$279m, ie a net liability position. Given the company appears to be in a net liquidation mode this negative working capital position could be treated as “quasi-debt”, effectively taking the total “net debt + quasi debt” to over $1.9bn. But even that may not represent the whole picture, as we need to take into account netting effects (JV payments), and the reliability of receivables/accrued assets vs payables/accrued liabilities

Of Tullow’s $737m trade and other payables $374m are accruals (mostly opex and capex). That’s materially down from last year as you would expect given reduced capex commitments, however, trade payables and other payables ex accruals and leases are materially higher: $172m vs $88m in the previous year. Its not clear what the reason for this would be unless Tullow is further delaying making payments to maintain its cash balance. Meanwhile Tullow’s current portion of lease liabilities is $152m, much of which one presumes is the gross amount due on the TEN FPSO for the year.

On the asset side of the balance sheet we have inventories - some warehouse stock etc which presumably isn’t that fungible to cash - $78m, oil stock which presumably represents oil in the FPSOs - so fungible - $54m, and then trade receivables. These are interesting as they have mushroomed from last year from $43.5m to $138m, with $124m of that being a gross gas receivable ($56m net to Tullow). Given the recent extension of the licence term to 2040 and the mention of a reduction in the gas price to the partners by the government, that $56m certainly looks less than bankable if it hasn’t been banked already this year.

Of the other current assets the bulk is the amount owed by JV partners back to Tullow of $350m. While we can assume that the chunk of cash owed by Kosmos to Tullow is bankable, we might question whether GNPC’s receivable is given, while current, it has been apparently lagging over from prior periods. We can assume for both that it represents owed JV payments on the TEN FPSO for the year, as well as operator fees for opex and capex (shown gross in accruals).

Using all this data, we can build a picture of the risked likely actual working capital draw of the business (see schematic below), given the material decline in production and exit from assets. Given historic delays in payment by GNPC certain current assets may not end up being paid “currently”, or where they are netted (in the case of the lease liability, Tullow may end up not being compensated in full. The net effect of all this is a potential draw on Tullow’s liquidity of more than the $280m or so that is suggested by the raw negative working capital balance (ex cash and borrowings). In fact the actual number could be as high as $380m on a risked basis, although this is an extreme case. But even assuming 50% of that drawdown occurred, that would wipe out $190m of cash and leave Tullow without any liquidity at all.

Here’s an expanded balance sheet table that simplifies and then risks (author’s judgement) the current assets and liabilities illustrating the risked net liability on Tullow’s balance sheet:

On that basis it becomes vital for Tullow, unless it is offered further debt by Glencore or other parties, to get the Gabon monies in quickly, before the interim period is closed, or risk potential insolvency. Even then, post that sale, the debt burden adjusted for working capital liabilities remains perilously high.

Production

Obviously if production were flat or even rising, a negative working capital position wouldn’t be so bothersome. However, Tullow’s main asset, Jubilee, continues to see a weak and declining production trend, with production far below optimistic predictions of a 100,000 barrel per day plateau. While production averaged 98,500 barrels a day of oil in March 2024, by March 2025 (adjusted for platform downtime) it was averaging approx 70,000 a day, down 28% year over year and 12% in 3 months. That contrasts with gas production, which has been relatively stable, just down approx 15% over the last 12 months. We don’t have figures for water production but we can assume that produced water is significantly higher over the period, adding further pressure to water handling and injection to replace voidage. Two additional wells for the year are unlikely based on prior experience to make much of a dent in that steep decline rate.

Until recently, Tullow’s other field, TEN had been the bright spot. However with unit production costs approaching $60 per barrel (including vessel lease costs) marginal cashflow from that unit is likely non existent, especially as recently production has resumed its decline trend to 16,500 daily barrels of oil in March 2025. Further decline risks cashflow for that asset turning materially negative as per barrel costs rise.

Conclusion

Given the ‘26 bonds are offering a yield of nearly 30% and are now current, Tullow very much may end up depending on “the kindness of strangers”. Even if it does, a net debt balance that remains stubbornly high, with minimal liquidity means any debt restructuring would likely lead to massive equity dilution or wipe-out.

DISCLAIMERS

The information contained above is not intended to constitute and should not be construed as investment advice and should not be construed as an offering or a solicitation of an offer to invest in any product or share. It is for personal use and information use only. It should not be relied on in the context of the investment objectives and financial situation of particular needs of any particular person or class of persons, and relevant advice should be obtained before taking any investment decision. The information above has been obtained from sources that we believe to be reliable and accurate at the time of publication, however, we give no warranty of accuracy as to the information or opinions offered above. Opinions given above are given at the time of posting and are subject to change without notice. The value of investments may fluctuate and you may not receive back the amount originally invested. Past performance is not a guarantee of future performance. At any time we may have a position long or short in a given company under discussion.

Each report on this substack post is opinion journalism. Brevarthan Research is providing its journalistic views about issues of concern based on facts that are fully disclosed to the readers. To the best of our knowledge, all information contained herein is accurate and reliable and has been obtained from publicly available sources that we believe to be accurate and reliable. Forecasts are the author’s own and subject to error or miscalculation. The information presented herein is “as is,” without warranty of any kind, whether express or implied. All expressions of opinion are subject to change without notice, and Brevarthan Research is not under any duty to update or supplement this presentation or any information or opinion herein.

In relation to readers from the United Kingdom, the research and materials on this website are being issued only to, and are directed only at, persons who are “Permitted Recipients” under the terms of the FPO (“Financial Promotion Order” - articles 19 and 45 - ie an “investment professional” or “high net worth individual”) and, without prejudice to any other restrictions or warnings set out in these Terms of Use, persons who are not Permitted Recipients must not act or rely on the information contained in any of the research or materials on this website.

Should we get short the equity?